During the COVID-19 pandemic, the industry of online grocery shopping services found its momentum to expand, providing an alternative suitable for social distancing. Today many consumers keep their acquired habit of shopping with their smartphones, taking advantage of the ease, comfort, and practicality.

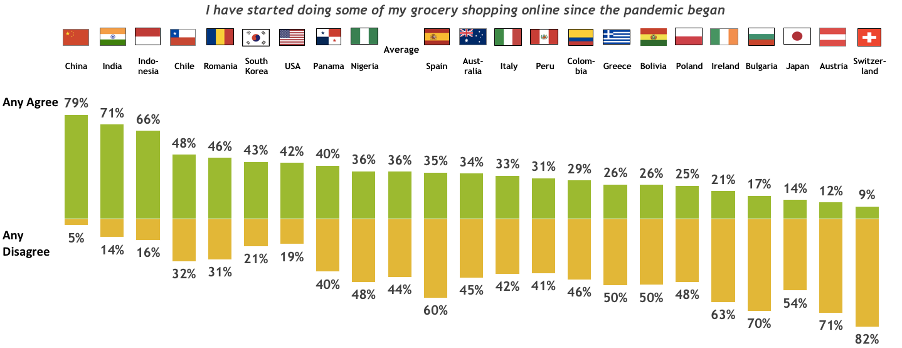

Conducted in 22 countries within the IRIS global network in August 2021, our market research in Indonesia found a big shift in grocery shopping from offline to online channels. Along with China (79%) and India (71%), respondents in Indonesia (66%) are the most inclined to indicate that they started doing grocery shopping online after the COVID-19 pandemic unfolded. This is well above the global average of 36%. The consumers’ new habit of shopping online is expected to become more established in the years to come despite the return to “normal” life in countries around the world.

One of the key drivers of the shift was government policies of implementing social restrictions for the majority of economic and social activities, forcing people to stay at home, especially during the height of the pandemic. In Indonesia, the government implemented Large-Scale Social Restrictions (PSBB) for several months in the early pandemic, followed by Community Activities Restrictions Enforcement (PPKM), a more adjustable series of restrictions based on epidemiologic measures combined with indicators such as vaccination achievement in a region, which was considered successful in reducing positive cases.

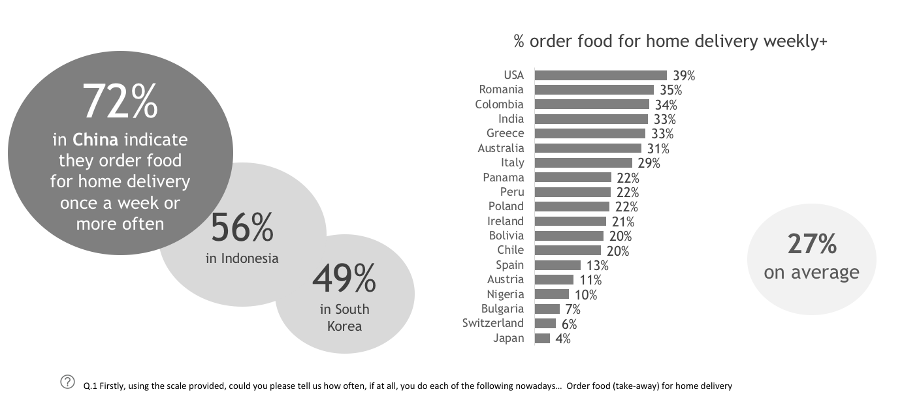

Reasonably, in comparison to two years before the study, the number of people buying fast food and going out for a meal decreased. Indonesians are highly likely to order food for home delivery once a week or more often, with more than half (56%) claiming to do so. In fact, Indonesia is the second highest market, with only China (72%) being higher, and both being much higher than the global average of 27% for ordering home delivery once a week.

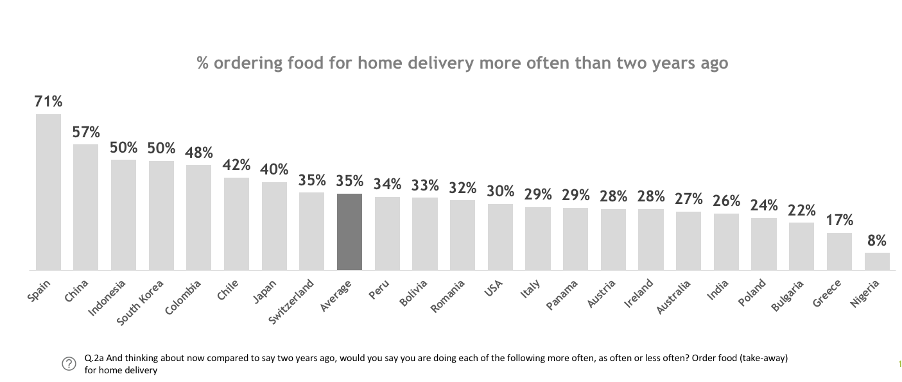

Furthermore, half (50%) of Indonesians who claim to be ordering food for home delivery do so more often now than they did two years ago (compared to the global average of only 35%), facilitated by the burgeoning online application-based delivery and expedition services in big cities all over the country.

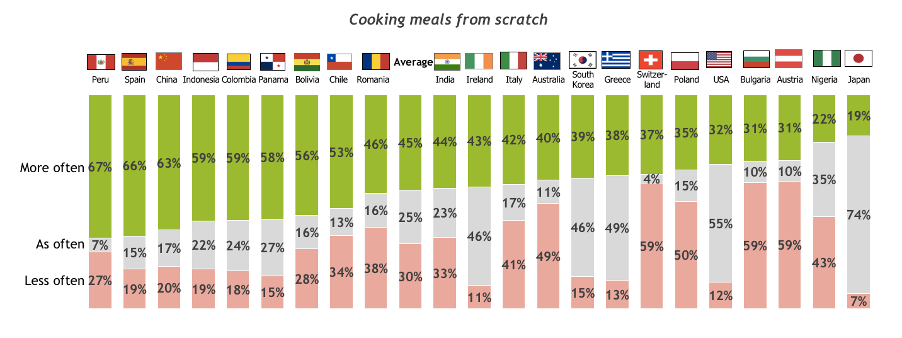

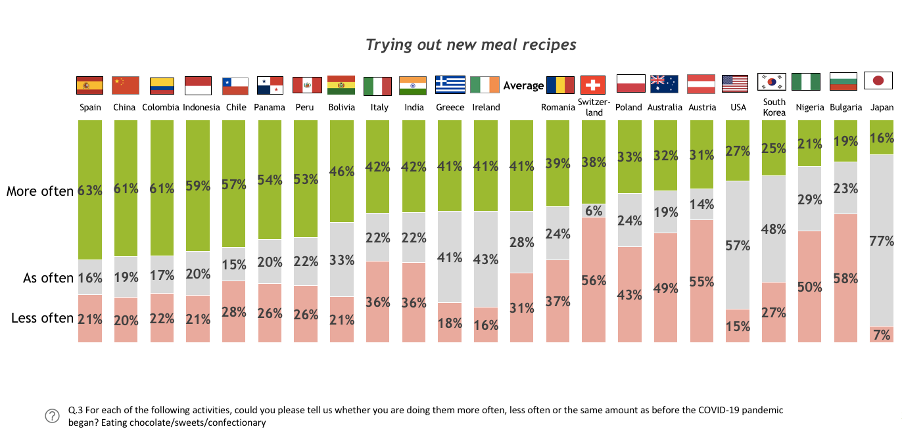

The survey also found a significant increase in respondents cooking meals from scratch and trying new recipes, which is equal to around 6 in 10. After the COVID-19 pandemic, 59% of Indonesians claim to do so, compared to an average of 45% globally, with higher percentages only in Peru, China, and Spain.

Similarly, 59% of the respondents claim to try new recipes, compared to an average of 41% globally. Again, only respondents in Spain, Colombia, and China are the most likely to do so.

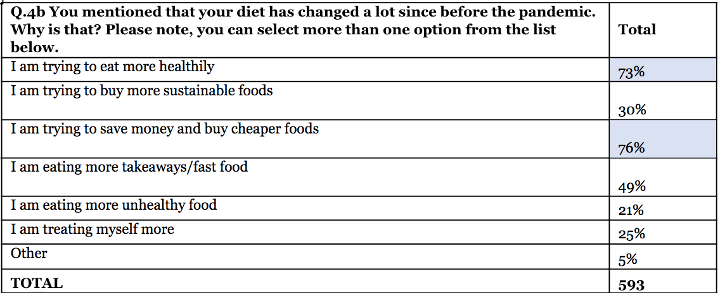

As the COVID-19 pandemic put greater importance on maintaining personal health, people nowadays are more mindful of their diet. The survey found that approximately the majority of respondents have changed their diet in order to eat healthily (73%) and save money by buying cheaper foods (76%). The downturn as the economy slowed down, leading to waves of layoffs and the collapse of many businesses, played a role in the latter. However, the ease and flexibility of online grocery services have also contributed to this habit, with online applications quickly catching up with the consumers’ demands.

Besides safety, the idea of home amongst Indonesians is inextricably linked to convenience and gatherings of family and loved ones as the communal spirit is strong in the multiple layers of society. Indeed, the COVID-19 pandemic emphasized the importance of home way more than before, with more people bringing celebrations back home with their loved ones. Indonesian consumers seem more likely to celebrate things at home than go out to a restaurant during the pandemic era. Two-thirds (66%) would stay home and cook a special meal to celebrate something, while nearly three-quarters (73%) would invite family or friends to their home to celebrate a birthday instead of going out to eat in a café or restaurant.

In spite of the national government’s policies and campaigns of the “new normal”, permitting people to socialize and businesses to reopen, our survey corroborates early studies in 2020 regarding the further potentials of online grocery channel to blossom in the Indonesian market. In fact, the DBS’ consumer market insight (end 2020) found that the rise of preference for online grocery channels was up to 700% in “the post-COVID-19” era, with penetration expected to grow fast due to “the increase of younger customers and rapid proliferation of mobile devices”. Simultaneously, home becomes the new place of entertainment, with 72% of respondents saying that they would prefer “to spend less time participating in activities outside the comfort of home, even after safe distancing measures and lockdowns are lifted”.

Meanwhile, in their report about COVID-19’s impact on Indonesian consumer sentiment (April 2020), McKinsey found a surge of community spirit and national pride, with 56% of respondents saying they “intend to buy more products that are produced in Indonesia or that hail from local businesses in their community”. This report also shows a clear shift from offline to online channels in nearly all consumer product categories.

Last but not least, according to a recent Google report (May 2022) on the future of Indonesia’s economy, online grocery services are predicted to contribute approximately USD 5–6 billion annually in 2025. The report also sees an increase of 24% in searches related to groceries during the first quarter of 2022, compared to the same period in the previous year, with an emphasis on healthy foods.

It's not that the existing players in the retail industry and others haven’t noticed this development. Many have seen potentials and moved accordingly. The uncharted, competitive territory thus sees fierce dynamics with start-ups floundering or even shutting down without interventions by venture capitalists or big conventional retailers. HappyFresh, an online grocery startup backed by Genesis, Innoven, and Mars, is one of the few that survive, unlike Brambang, while TaniHub pivoted to serve B2B consumers instead of individual ones. As for the big players, Transmart of CT Corp, which acquired Carrefour in 2013, to name one, has built a joint venture with Bukalapak, Salim Group, and others to pitch in and try the online grocery market.

All the findings above show a new trend in grocery shopping that will shape the future of the industry, with consumers now having more options and control in the comfort of their homes, and players gearing up to answer the call. As life return to the “new normal” after all restrictions are lifted, for many of us, the new habit of scrolling the screen to fill the fridge stays and becomes a new fixture of our ordinary life.