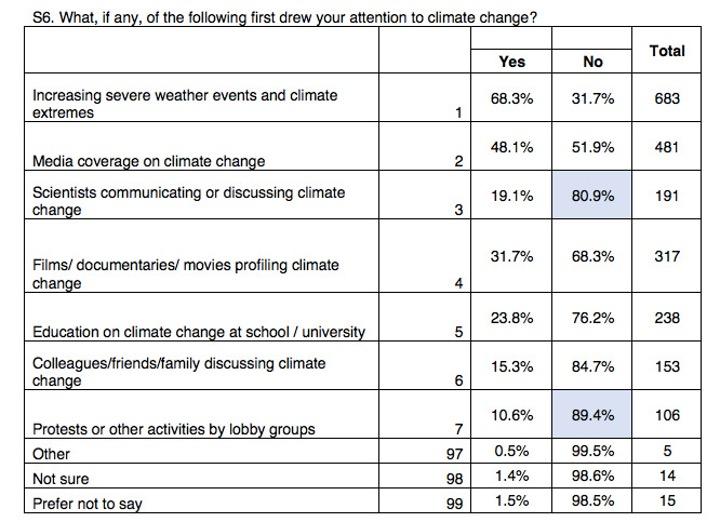

According to our study last year on citizens’ perceptions on climate change in 13 countries, over 90% of Indonesian people are anxious and fearful. In dealing with uncertain timeline and anticipating multiple threats from climate change, our survey found Indonesians felt thirsty for information beyond the matter of obvious severe weather events and climate extremes. There are indeed multiple entry points to mainstream the issue of climate change, from media coverage, and popular culture, to the school curriculum. Yet some of these potential sources of awareness, for example, risk communications by scientists and other authoritative bodies and public protests and campaigns by civil society organisations, made little influence to shape public discourse on the vast detrimental effects of climate change.

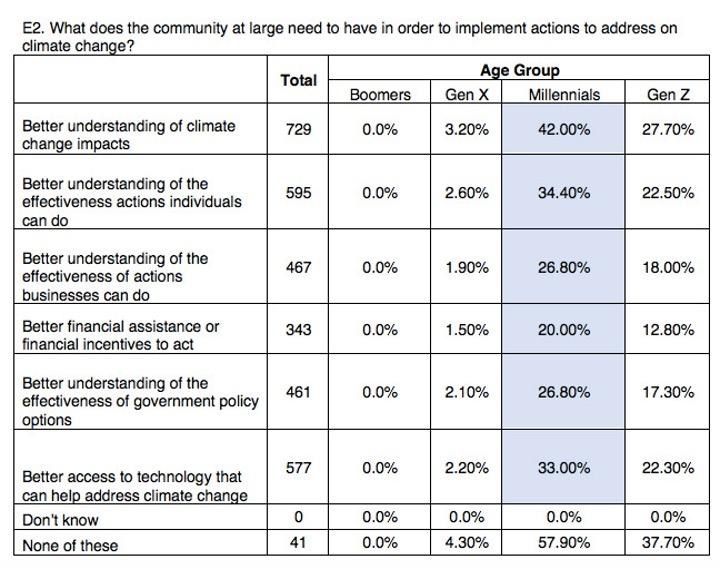

Accordingly, Indonesians seem to be seeking opportunities to bring individuals and the community at large to participate in any kind of possible solutions to reduce the burden of climate adaptation. They were inclined to take personal actions because their own world is literally at stake. Millennials score high in all kinds of needs of knowledge to act is far higher than other age groups. Amongst all countries on the survey, the personal importance of climate change is highest in Italy, India, Switzerland, and Indonesia (33% extremely important, 48% very important).

The good news is today’s world has plenty of room to allow individual engagement in the efforts of developing a fair, sustainable, and resilient future. Along with other countries, Indonesia plays a crucial role in global efforts in advocating the idea of sustainable and responsible investment. In the context of Indonesia, ‘impact investment’—a kind of investment focusing on positive social, economic, and environmental impacts, is championed by many and it slowly gains traction from the public. Last year, the first ever green bonds worth Rp 35 trillion was successfully issued by the government of Indonesia. In the domestic financial market, the number of green investment products in the forms of mutual funds, stocks and shares, consistently grows. According to the Indonesian Stock Exchange data, there was only one ESG (economic, social and good governance) - based product worth merely Rp 35 billion in 2016, and the figure was multiplied by 82 times in 2021.

As of the end of semester 1 of 2022, Millennials and generation Z are the dominant players in Indonesia’s stock market. Both age groups represent over 80% of investors with a total asset value worth Rp 144 trillion. With climate investment shifts, individuals can decide on the advantages they want to ripe from their investment beyond financial benefits. Indonesian young citizens can do their part too by aligning their interest in protecting the world with their motivation in creating a financial cushion for the long run. If they can change their mindset and practices in channelling their money for social causes, responsible and smart investment can be an act of caring. The responsibility of protecting the earth is possible without sacrificing the economy altogether.